Embracing the Experience Economy

Banks, Financial Services and Insurance (BFSI) organisations are key drivers and enablers of the wider experience economy that empowers funding, trading and consumer purchases. They also need to embrace and succeed in the experience economy. This means they need to maximise the use of online channels to ensure positive customer experiences and business growth.

Winning in the experience economy requires building a brand, services and customer experience (CX) based on 24/7 availability, personalisation, humanity, personality, social purpose, storytelling, connection, and passion. Research shows credit card customers who feel emotionally connected are likely to spend 46% more annually than those who are merely satisfied, and their lifetime value will be eight times higher.

BFSIs must balance these factors against general sector challenges like skills shortages, constant pressure to optimise costs productivity and efficiency, and the need to devote appropriate budget to meet changing regulatory requirements.

Initially, BFSI was slow to adopt a CX-first approach, but by 2021, 70% of financial institution executives were convinced that CX is a key investment area. To this end, Forbes predicts that 2023 will be the “year of the chatbot” and, according to Statista, the global BFSI chatbot market is expected to go from $0.59bn in 2019 to £6.83bn by 2030.

BFSI & the Cost-of-Living Crisis

Amidst the current cost-of-living crisis, 63% of banking customers are complaining their bank has failed to give them advice, while 66% who have had advice said it was unhelpful. It’s not only customers who are concerned. According to recent research by KPMG, 45% of bank executives consider their organisations to be ‘below average’ in terms of securely building solutions and deploying underlying technologies to help customers.

AI Chatbot Use Cases in BFSI

In the BFSI sector, AI chatbots can execute informational, transactional, advisory, lead generation, and feedback services in a personalised and efficient way. This reduces operational expenditure (OPEX) by enabling customer services, marketing, and sales employees to focus on more complex and business-critical tasks. Chatbots can also cross-sell and upsell, enable referrals, as well as offer rewards and loyalty schemes to acquire and retain customers, reduce churn and increase revenue. They also play an essential role in an omnichannel marketing and sales strategy, as they can be deployed across your website, WhatsApp, Viber, and Facebook, allowing you to meet your customers on their preferred channel.

In our previous blog on the Finance sector we cited the Juniper research that demonstrates that chatbots will save banks up to $7.3 billion worldwide by 2023, but did you know this equates to a mind-blowing saving of 862 million hours of work?

So, let’s look at different types of BFSI chatbot and see how they can create a CX to win the experience economy.

1. Informational Chatbot

The simplest chatbot use case for the Finance sector is designed to provide general information that most customers need - usually FAQs about the organisation and its services. It’s possible to use a simple rule-based chatbot. However, BFSI organisations that want to win the experience economy should invest in a chatbot with AI, Natural Language Processing (NLP) and Machine Learning (ML) to enable customised capabilities like translating languages, moderating and updating content, and smart recommendations.

Globally, across all sectors, businesses spend $1.3 trillion solving customer queries. AI chatbots can potentially help organisations save up to 30% of this expenditure, and, by 2026, Gartner predicts AI chatbots will reduce call centre costs by $80 Billion.

The speed and 24/7 availability of the informational chatbot are two of its greatest benefits, with 64% of banking advisors saying it frees them to solve complex customer problems. This can have a significant impact on BFSI revenue as 86% of customers will pay more for a better customer experience, and this uplift could be as high as 13%-18%.

2. Transactional Chatbot

Transactional AI chatbots integrate with the bank’s back-office systems through Robotic Process Automation (RPA). They automate repetitive and menial financial advisor tasks. This reduces OPEX and eliminates the risks and costs of human error. It unburdens employees, affording greater job satisfaction, employee retention and cost savings. Oracle recently reported that 53% of employees are “optimistic and excited” about having AI chatbot ‘co-workers’.

In banking this type of bot handles self-service processes like fund transfers, bill payments, loan repayments, push notifications about account activity and security. They can detect fraud by using trends analysis that highlights anomalies like unknown IP addresses, flagging up two-factor authentication failures, or using biometric voice and facial recognition.

In insurance, its use cases include account set-up, claims filing, damage assessment via image and video recognition functionality, claims processing and settlement. It's no wonder that, according to Deloitte, 74% of insurance executives are planning on increasing their investment in AI.

3. Advisory Chatbot

Conversational advisory AI chatbots rely on recommendation systems powered by Machine Learning (ML) to examine a customer’s past behaviour and previous conversations, build up a customer profile, as well as predict which products are most likely to appeal to them. They help boost revenue by enabling efficient cross-selling and upselling through personalised packages promotions that boost conversions. Hyperautomation and personalisation increase conversions, while reducing OPEX and boosting profits. According to a recent article in the ABA Banking Journal, upselling and cross-selling to current customers has a 60-70% chance of conversion compared to acquiring new customers that typically see conversion rates of 5% to 20%. Additionally, an advisory chatbot can provide customers with a financial health-check and recommend improvements to help customers navigate the cost-of-living crisis.

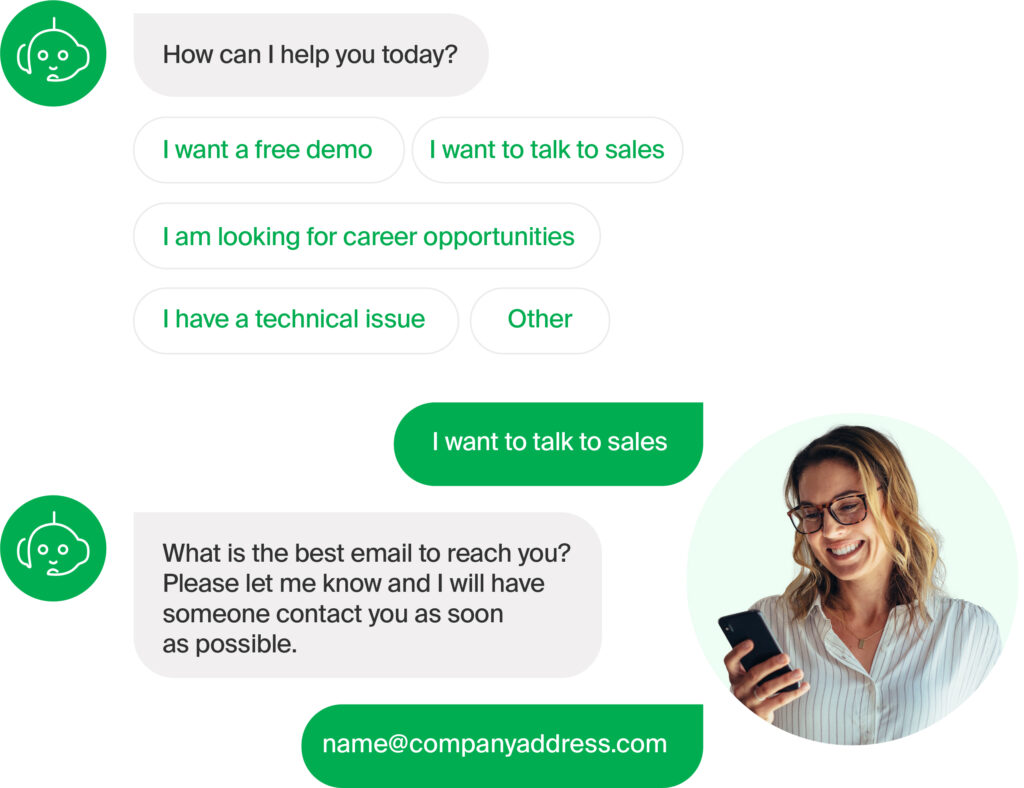

4. Lead Generation Chatbot

There’s no doubt chatbots are great for lead generation. HubSpot recently reported a 182% uptick in qualified leads from deploying a hybrid strategy combining humans and bots.

AI chatbots can identify and qualify BFSI leads using NLP to recognise common words. The process is much faster than sending marketing emails and waiting for a prospect to reply, and less frustrating for the customer than filling out a pop-up form. On a website, they start a conversation mimicking human-to-human interaction, complemented by graphs and images, which keeps the customer engaged and reduces the bounce rate. They can also collect critical data, segment the prospect, qualify the lead, and add it to the CRM, which helps boost conversions. Their scalability means they can handle large volumes of sales queries 24/7 without driving up costs.

5. Feedback & Surveys Chatbot

Enabling customers to give feedback on products, solutions and customer service is critical to winning the experience economy. It helps your customer feel heard and allows organisations to make continuous improvements based on customer needs.

A recent SurveyMonkey report shows 85% of customers will give their feedback following a good experience and 81% after a bad experience. Related research shows that 50% of complaints are made publicly on social media and 81% of those that don’t receive a response won’t recommend that company to their friends and followers. A feedback and survey chatbot on a website can pre-empt and prevent a public complaint. Alternatively, on the customers’ preferred social media channel, the AI chatbot can send an immediate response to a customer complaint or help direct more complex issues to a customer service rep. Both use cases preserve the BFSI organisation’s reputation, assist other customers with similar issues, and proves that the organisation cares about its customers. This means that customers are more likely to remain loyal and recommend their services, preventing churn and boosting revenue.

Not All Chatbots Are Equal

Forrester found that 95% of financial firms want their chatbots to record and analyse customer history, but only 55% have that capability. Similarly, 91% want their chatbot to automate actions in response to customer queries, but only 52% can.

To win in the experience economy your bot needs to have heart and soul. Pick a great name that fits your brand, or for maximum emotional buy-in, run a campaign allowing customers to choose its name. Inject your brand personality into your AI bot so customers enjoy the interaction. Above all, remember that a great CX isn’t only about the chatbot, you need to analyse the data it collects and use it to improve not only your products and services, but the chatbot itself.