Why are MNOs still missing out on A2P SMS traffic revenue?

Mobile network operators’ (MNOs) business rests on three pillars: data, voice, and SMS.

The last one often becomes an operator’s poor cousin — left out of focus and low on the priority list. Which is rather strange, considering the fast pace of the global A2P SMS messaging market growth: from $11.86 billion in 2017 to $26.61 billion in 2022, according to Mobilesquared’s forecast.

MNOs are confused. Year after year, instead of growth, most of them have been watching a decline in SMS traffic to their networks and taking painful revenue hits, about $10 million per annum on A2P SMS. Could the international researches be wrong in their prognoses?

Practice shows that their figures don’t lie. It would be easy to cast all the blame upon ‘inescapable’ fraudsters with their ‘untraceable’ grey routes and SIM farms. But let’s try to look beyond and see if there might be some other explanations.

Choose the red pill

SMS services management has historically been divided between different business departments of MNOs, such as B2B, B2C, Roaming & Interconnect, and Marketing. It’s no wonder that mobile operators can’t wholly recognise the value of this asset.

As Oleksandr Miroshnychenko, GMS’ Head of A2P points out, we work with more than 900 operators, and it is rare to find someone who knows every detail of every aspect of their business — the whole network, its SMS traffic, and all the messaging services they provide.

There are SMS firewall solutions which can help an MNO to make its network transparent and take all of its SMS traffic under control. However even then, the operator will not be able to see and explore the full revenue potential of its A2P SMS traffic. It will still be at the end of the data chain, unable to clearly understand in which cases enterprises interact with a user by SMS, leaving space for fraudulent activities and unprofitable transactions with partners.

Gain deep knowledge of the network

According to Mobilesquared’s report, white-route traffic accounted for 88% of total revenues in 2017, even though it represented just over half of all A2P SMS traffic. This means that up to 50% of all international SMS traffic coming to MNO networks is under-monetised.

For a mobile operator, the least time-and-investment-consuming way, and indeed a very effective way, to add up to 10 million to its KPIs, would be to cooperate with a trusted international messaging hub. Such companies, besides an ability to follow traffic and examine different data waves in real time, have direct contracts and connections with most enterprises generating A2P messages.

Head of A2P division at GMS.

It’s not a puzzle. GMS does global business. We constantly gather analytics on the type and volume of SMS traffic in and between different countries and continents, and aggregate expertise about the market and players.

A global hub like GMS can provide a mobile operator with a helicopter view of the international A2P SMS market, helping them to see the full picture: from technical, commercial and legal angles and, finally, explore the true and full revenue potential of the MNO’s A2P traffic.

Head of A2P division at GMS

I am shocked that you know much more about my network than I myself do — is a common phrase we hear from clients.

Under-monetised “grey” traffic

Before discussing monetisation opportunities, it’s worth it to come to a common understanding of what a ‘grey’ route really is. In the true commercial sense, under-monetised traffic, i.e. traffic that is terminated at reduced prices must be considered grey, even if it comes from an authorised channel.

What do we mean by “authorised”?

Usually, an MNO believes that only unauthorised routes can be ‘grey,’ but actually, operators seem to interpret this description broadly and differently. Let’s take an example here.

Uber, whose service is built on SMS business logic reaches out to an MNO to send A2P messages via its network. Being an international company, Uber officially registers a legal entity within the country, with the same name. And this brings us to every operator’s dilemma — how to accurately categorise A2P traffic from Uber: as local or international? Uber for sure, will try its best to merge and send all messages under the guise of local traffic to take advantage of the lower local prices.

Considering the number of OTTs on the market, an operator faces and must tackle many similar challenges. One popular way for MNOs to do this is by setting a strict rate for all A2P messages, like $0.01 for each. But a simple solution does not always do the trick.

Divide and conquer your traffic

The very first thing to do in order to identify and categorise traffic correctly is to separate it into national and international traffic. That’s where an external partner steps in.

An international hub can help to separate the traffic into two categories, with different alpha names and additional control through the SMS Firewall. Considering the vast difference in monetisation rates for global and local SMS traffic, traffic division provides high incremental revenues — that’s what gives an MNO the basis to be proactive and make changes on its network.

Make your own rules for traffic identification and separation

Head of A2P division at GMS

We use about 15 basic parameters, tried and tested in different regions, that allow us to define the service and the traffic from it as an international one.

There’s no generally accepted strict list of rules which governs this.

For example, a service can be monetised as international, if it fulfils the below criteria

- It is headquartered outside the country

- It has operational activities in two or more countries

- It is using franchising

- Its TM holder is a global company

- Its company’s website domain name is registered abroad

On the basis of transparent rules, the mobile operator can build effective financial relations with its partners without misunderstandings and the risk of losing traffic.

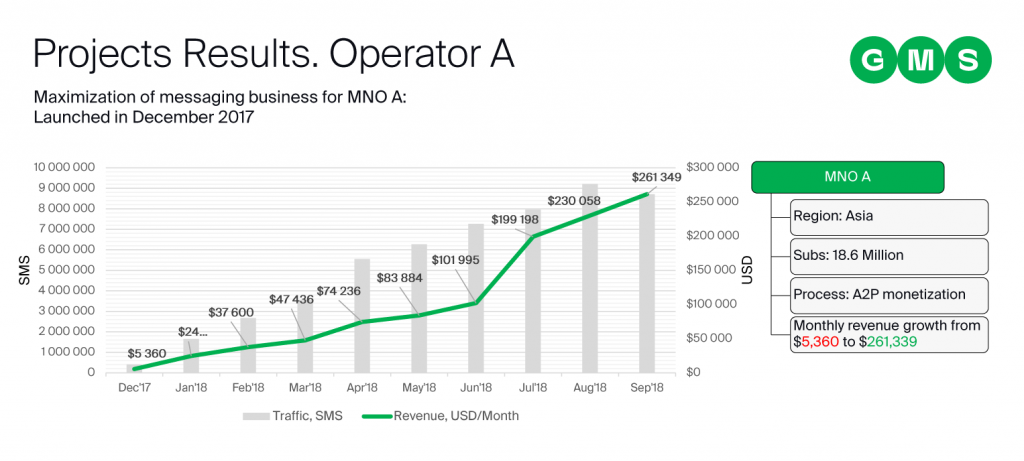

Progress doesn’t always take long

Using the help of an international Hub which has developed contacts and a contract structure with most enterprises sending A2P messages, it takes just a few months for an MNO to see and close revenue holes in its network.

Head of A2P division at GMS

From the moment the operator makes a decision to use GMS’ monetisation solution and launch proper pricing of its A2P SMS traffic, it takes us two or three months of tests and fully-fledged work on the network to set clear conditions and separate international traffic from local, check agreements with partners, to block all the grey routes and revenue holes. Only after that will the MNO’s profits from A2P messaging finally meet the target.

Takeaways

While the global A2P SMS messaging market will grow almost by double and reach $26.61 billion in 2022, the key challenge is for mobile network operators to monitor adequately, control, guard and therefore monetise their SMS traffic and make the most out of your messaging infrastructure.

Stop letting potential revenue slip away via grey routes and improperly categorised channels — talk to a GMS expert and find out how to unlock the full financial potential of your network.