During the pandemic, mobile networks and the internet have become a primary means to keep society together, connecting people and businesses and allowing them to carry on with work, learning and other daily activities despite quarantine restrictions. A significant increase in mobile services adoption reflects the utility of mobile technology in these challenging times.

Sub-Saharan Africa is a region that boasts fantastic potential for a booming mobile economy, thanks to its large, youthful, gender-balanced, tech-savvy population. Mobile networks remaining the only form of internet access for a major part of the population is another factor that drives mobile adoption. Let us have a closer look and see how post-covid trends affect this fascinating market.

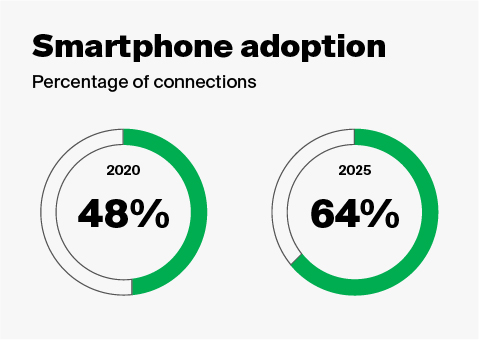

Low smartphone adoption makes SMS king

Despite significant mobile phone penetration, the adoption of smartphones remains relatively low due to unaffordable tariffs and low internet availability in certain parts of the continent. So, while messaging apps are beginning to play a more significant role in A2P communication in Africa, the market remains restricted. This makes SMS a primary channel for communication between brands and consumers.

Connectivity and demographics

According to GSMA, at the end of 2020, 303 million people — 28% of the population of Sub-Saharan Africa — had access to the mobile internet. With digital services being at the heart of a post-pandemic world, the urgency to bring unconnected communities online has never been greater.

Strong investor confidence and consumer interest in digital platforms point to Sub-Saharan Africa’s digital- and mobile-centric future.

In turn, mobile operators have taken measures to support vulnerable communities and governments’ pandemic response efforts by offering discounts on mobile tariffs and providing digital content and tools to help people and businesses get online. By 2025, over 170 million people across the region will have started using mobile internet for the first time, bringing the penetration rate to just under 39% of the population.

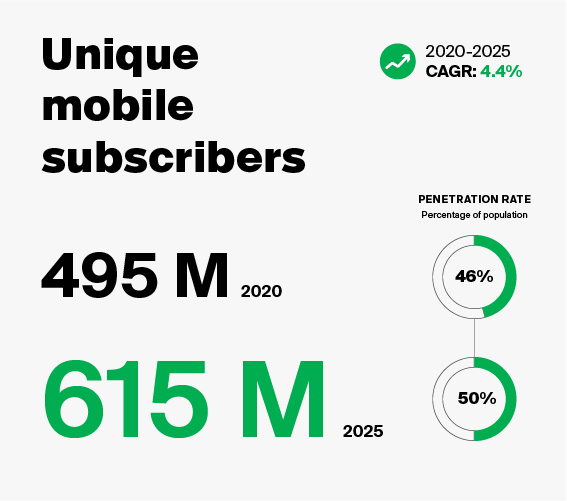

By the end of 2020, Sub-Saharan Africa’s mobile services’ audience accounted for 495 million people or 46% of the region’s population. With over 40% of the region’s population still under the age of 15, young consumers receiving their first mobile devices will serve as the primary growth factor in the foreseeable future. There will be around 120 million new subscribers by 2025, taking the total number of subscribers to 615 million, or half of the region’s population.

The rise of digital platforms

Digital platforms play an increasingly vital role in developing economies, reducing inefficiencies in traditional business models and making the services accessible for a broader audience. In Sub-Saharan Africa, many startups launched during the last decade have grown exponentially and are now helping to deliver better quality education, improved health outcomes and other positive societal contributions for millions of people.

The financial services and healthcare sectors seem to be most appealing to the investors, with 50+ fintech companies in the region raising around $821 million in funding in 2020 — a third more than the previous year. While the amount raised by health-tech companies during the same period is considerably less at $110.6 million, it still represents a more than threefold increase compared to 2019.

The coming years will see digital platforms move to scale their operations to capture new opportunities within their domestic markets and across the region. In many cases, this will be achieved through consolidation to create synergies and through geographical expansion into new markets.

Mobile operators play a central role in Sub-Saharan Africa’s digital platforms landscape, primarily as providers of connectivity to access and distribute digital services, but increasingly as providers of digital platforms through direct ownership, investment and/or in partnership with third-party tech innovators. Examples include the following:

- MTN Benin does not charge its subscribers for traffic consumed while using the Gozem app, allowing drivers and riders to use the platform free of charge.

- Safaricom is developing a mobile-based digital health platform that allows users to access a copy of their health details and share it with trusted health providers.

Revenue opportunities and threats for MNOs

Digital platforms provide several benefits for operators, generating new revenue streams from adjacent services, encouraging subscribers to use more data, and creating opportunities for market differentiation and added value for customers.

However, this digital transformation has brought in a new group of customers, providing fraudsters with a new audience to target. As user-oriented fraud mainly occurs through social engineering, operators need to protect their subscribers from SMS phishing and malicious software. Deployment and ongoing management of an SMS firewall to identify and block spam and number spoofing, as well as more advanced solutions like the Zero Trust approach can help mitigate these risks, protecting the operators’ reputation, as well as providing protection from more traditional threats like grey routes.