The telecommunications industry left 2020 in a strong position compared to many other sectors. While a general economic downturn has affected operators’ ability to deploy new technologies such as 5G or RCS, the long-term prognosis looks good. The A2P messaging market alone is set to be worth $72.8bn by 2025.

But what about the short term? What will 2021 hold for the world of telecoms? Let us look at some of the established and emerging telco trends 2021.

Covid-19 will continue to be a factor

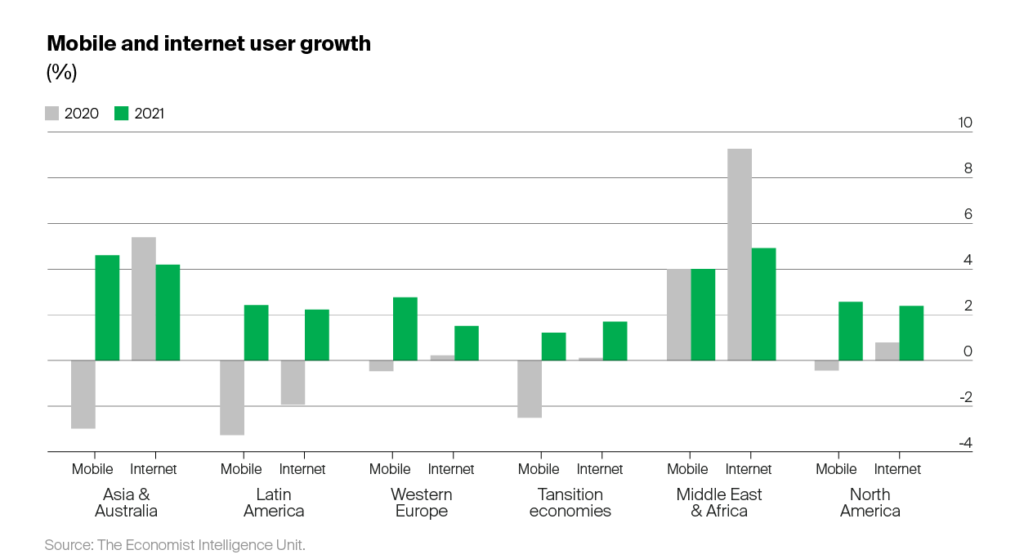

The world economy is already working towards its recovery from Covid-19 lockdowns, with industries looking ahead to a post-vaccine world even as they adapt to the new normal. Telecoms will continue its strong showing compared to other industries, with the Economist Intelligence Unit (EIU) predicting a solid recovery in both mobile subscriptions and revenue in 2021, particularly in Asia and the Middle East.

As economies recover and subscriber spending power increases, mobile will see a marked improvement, averaging about 3.4% growth according to the EIU. This not just because subscribers are freer to spend on subscriptions and top-ups but also because mobile will be so central to the new emerging economy where online ordering and deliveries will be greatly facilitated by mobile messaging.

This recovery will in turn allow operators to revisit their plans for commercial and technological development, which in some cases were put on hold due to the uncertainty of 2020. However, we believe many will continue to be cautious: the overall health of the economy will determine many important variables, from enterprise demand for messaging to subscriber willingness to pay for 5G tariffs.

Digitalisation will drive messaging

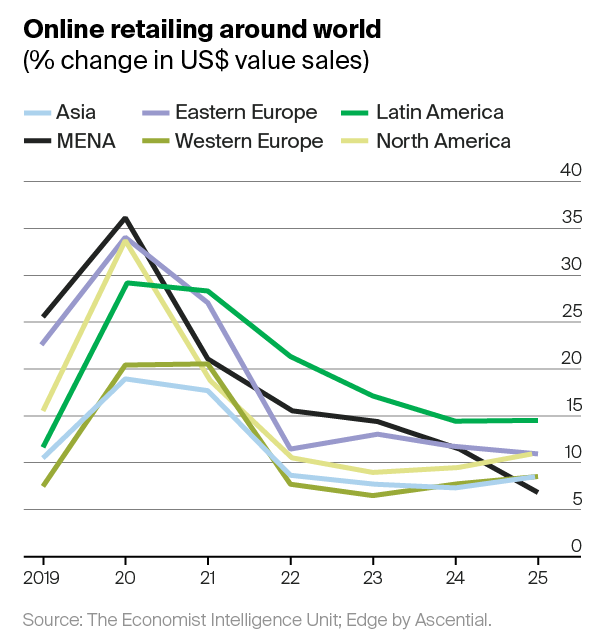

One of the main economic effects of Covid has been — and will continue to be — to increase the pace of digitalisation. Where once the shift to digital was a response to consumer preference and the opportunities made available by technological advancement, now it is becoming a pressing need. Online retail has surged in Asia, the Middle East, and Latin America, particularly in online food and grocery deliveries.

Numerous enterprises have had to adopt some measure of digitisation to stay competitive, even those that traditionally rely on consumer foot traffic. For instance, large retailers are shifting their business model, turning their retail space into localised fulfilment centres. Much more of their business is being done via online ordering, and physical locations are increasingly functioning as pick-up locations.

Even without Covid, however, digitisation would remain a major trend. New technologies like conversational commerce and augmented- and virtual-reality (as well as the need to compete with major online retailers like Amazon) encourage a shift to a digital approach to core business functions.

Digitisation also can refer to internal processes so that it is not just retail that is increasing its reliance on digital — it is practically every sector. Again, Covid has increased a move to remote working, but there was a growing trend towards paperless work and a cloud-based approach to services and processes even before the pandemic.

All these applications will translate to a robust flow of messaging traffic. Although promotional messaging, particularly for retail, will probably take more time to bounce back, authentications are already making a strong showing. However, the sensitive nature of such messages will require operators to tighten up on fraud and spam detection.

Mobile identity

MEF is predicting that mobile identity will become an important part of the digitalisation process as companies turn to additional authentication layers to protect access to sensitive systems or user data. While this means more authentication traffic, it is also an opportunity for operators to become a much more central part of the identity ecosystem.

While many people currently use their Facebook, Apple, or Google account to sign in to various internet sites, they could in future start to use other, federated identity services like those proposed by the GSMA. As consumers become more aware that — in the hands of large, data-driven companies — they are often the product, they will be looking for identity services from reliable providers who do not have an incentive to monetise their service usage.

Mobile operators are ideally placed to provide identity services for logins and authentications because they are generally trusted, and mobile phones already play such a prominent role in people’s day-to-day lives. They also have a strong position when it comes to existing and future regulatory conditions on identity and user data. All these factors will be necessary to respond to the challenges facing consumers and enterprises today.

The success of 5G will depend primarily on novel functionality

5G is becoming an increasingly well-worn topic. However, while much public discussion focuses on where the infrastructure is strongest — data speed — many within the ecosystem are looking at how 5G will really justify itself. This means its ability to support other, often enterprise-grade, technologies like augmented reality and connected devices.

Large-scale IoT will be a major driver of success, as we already posited, since the efficiency of connected devices (from industrial automation to driverless cars) will be significantly boosted by edge computing and ultra-low latency.

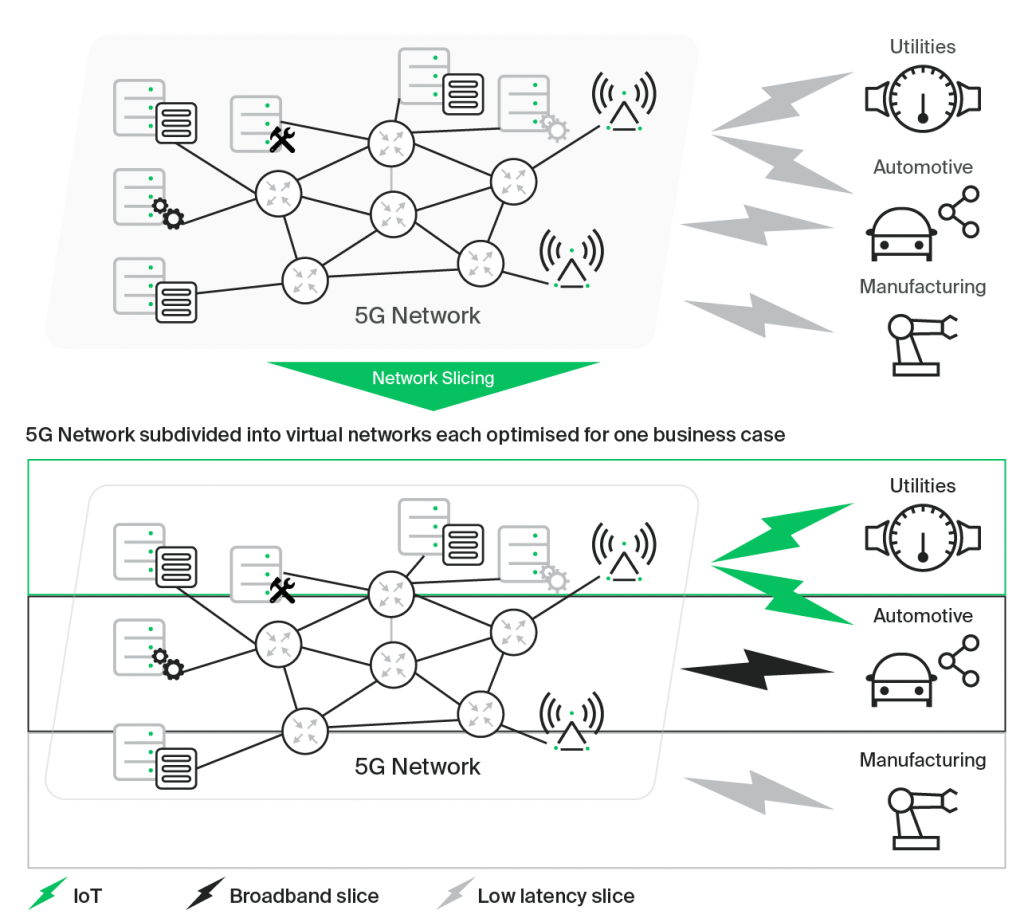

This trend also extends to other use cases that are not truly IoT but centre on 5G’s ability to connect devices in new ways. Experts have highlighted, for example, the ability to create virtual networks over public networks, which will increase security for retail and financial enterprises. Next-gen networks’ ability to serve various connection needs will be what makes them commercially viable — speed is really just a number.

Source: GSMA, ‘An Introduction to Network Slicing’

Operator revenue diversification will be a priority

Operators will always be looking for ways to grow and stabilise their revenue streams. To this end, GSMA Intelligence has identified operator revenue diversification as a key research focus for telco trends 2021. While they note that part of this may come from M&A activity, this is only likely for large operators and groups — for the most part, GSMA thinks that revenue diversification will come from going ‘beyond core.’

This means providing services outside of mobile and fixed connectivity, expanding into areas like pay-TV and IoT. By offering new services over the top of their core business, operators can build a more robust business case and counter stagnating core revenues.

We think that many of the telco trends 2021 mentioned above provide ample opportunities to broaden an operator’s revenue base and avoid becoming merely a provider of connectivity. Operators should look to offer identity and IoT solutions and find ways to benefit from the growth of rich messaging that too often goes OTT. As economies, enterprises, and individuals adjust to the new normal, 2021 will be a turning point in establishing new offerings.

The year ahead

2021 will see the world’s markets adjusting to the challenges of 2020, and while telecoms is in a good position relative to other industries, there is still much to discuss and do. Operators will want to keep track of emerging telco trends 2021 to see how they can best respond to the broader economy’s needs and opportunities.