Latin America is a dynamically developing market commanding an immense potential for mobile operators and business messaging providers. It is one of the most urbanised regions with a reasonably young population (median age of 31). While there are around 408 million unique mobile users, 24% of the region’s people are still too young to own a handset, which means a tremendous surge in mobile adoption in the nearest future!

In this article, we take a closer look at the LATAM market and discuss the opportunities for the messaging business in the region.

A2P SMS adoption: large enterprises are lagging behind

According to MEF and Mobilesquared, the A2P SMS revenues for Latin America are estimated to reach $1.17 bln by 2025 (compared to $723 M in 2020). This change was at least partially prompted by the pandemic that had pushed businesses towards messaging as a new, better way to engage with their customers.

Despite this, only 3.1% of LATAM brands use A2P SMS, generating the whole $723 M, with microbusinesses generate 89.4% of said volumes. In fact, large businesses only contribute 2.4% of A2P traffic, and educating large enterprises about the benefits of A2P SMS should be a priority for mobile operators.

More prominent brands should realise that SMS is still an incredibly viable channel with almost unparalleled delivery and open rates, which is fantastic for delivering transactional messages, one-time passwords and other urgent notifications. While 2FA and other security-oriented messaging generated by banks and financial institutions constitute the most significant portion of the region’s A2P traffic, similar results can be achieved in other industries. One of the effective ways to grow the A2P traffic volumes could be to lower the data plan prices and encourage the subscribers to engage more actively with the applications, as more frequent use of the apps transfers into more A2P messages.

Tackling grey routes to increase revenue

Another revenue opportunity for mobile operators is proper traffic monetisation. According to Andy Jones, Principal Consultant at Mobilesquared, 47% of LATAM’s A2P traffic is through grey routes. Investing in thorough messaging business assessment and modern firewall solutions can help operators unlock untapped revenues.

A thorough examination of an MNO’s messaging business is a vital step for monetisation efforts. By studying the traffic structure and origins, regulatory and contractual environment, technical and financial performance, MNOs can better understand their network’s internal and external conditions. Such a service could be of particular interest in Latin America as one of the common issues for local operators is obsolete commercial agreement terms, some of which have lasted for 20 years without a single review, despite the constantly evolving messaging landscape.

Firewall deployment, in turn, can serve both as the means to sift out the grey traffic and as a tool against the new types of fraud threatening the subscribers’ wellbeing and consequentially harming A2P SMS’ credibility as a reliable business messaging channel. And once the security is tightened up, operators can consider slightly raising the price of A2P messaging.

Rich Communication Services (RCS)

This standard offers its audience access to features similar to messaging apps (as well as a couple of unique ones) and promises to match the reach of SMS. RCS messages can include images and GIFs, video, interactive elements like rich cards (which can be collected into catalogue-like carousels), branding, and more. It also integrates with smartphone services and apps like geolocation, maps, and calendars.

Latin America has been growing swiftly in terms of RCS adoption: while today 28% of Android users in the region have RCS functionality on their devices, this figure is expected to rise to 86% within four years. Until then, however, SMS remains the primary communications channel, native to all handsets in the region.

Brazil as a model market

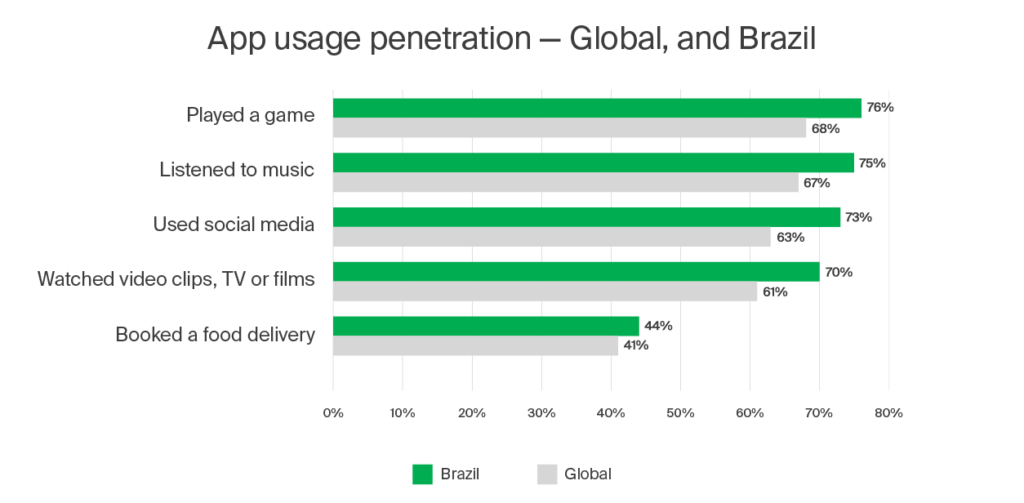

According to MEF’s Mobile Apps User Survey 2021, Brazil is an absolute global leader in mobile application penetration, making for a fascinating reference market.

As mentioned above, local data costs can significantly inhibit frequent app usage, and this is indeed what is happening in Brazil. Relatively high prices mean that the mobile app frequency of use in the country is far lower than the global average: despite higher penetration, the actual social media app use frequency in Brazil only reaches 38% compared to 84% worldwide.

Another peculiar thing about the country is that despite 92% of mobile users receiving business messages, only 29% receive A2P SMS (for comparison, 59% of respondents received business messages via OTTs and 55% — via emails). In this situation, reducing the data costs should be one of the first steps that operators should take in order to facilitate A2P SMS adoption.

Finally, only 13% of smartphone users in Brazil never received spam or fraudulent messages, which indicates a lack of proper SMS firewall protection.

Next steps

With the promise of a steady smartphone penetration increase in the future, the LATAM market indeed offers fantastic revenue growth opportunities for mobile operators. However, this will require steps like tightening up the MNO messaging protection since the grey routes and unsecured networks are a massive limiter on growth in the region.

Additionally, operators can boost A2P SMS adoption by directly educating larger local enterprises about the channel’s benefits and stimulating app use via reduced data costs.