5G has often been treated as the next big thing for telecoms tech. As we argued previously, many of its most interesting facets go beyond speed — and this raises questions about the current state of the technology because those capabilities and their use cases need more than just a new kind of radio access network.

The pattern and speed of deployment therefore defines 5G’s medium-to-long term prospects. And now, of course, operators may have other priorities.

Many industries are feeling the impact of the Covid-19 outbreak, and telecoms is no different. In particular the deployment of 5G is expected to experience a delay, as countries delay spectrum auctions and operators focus on the more established and reliable 4G networks that are so crucial to maintaining communications during the quarantine.

Even the more optimistic projections are very circumspect and narrow in scope. It is by no means certain that networks will be ready to deliver 5G, even if there is demand for it. But this has its roots in the history and logistics of 5G deployment itself. The fact is that the pandemic occurred concurrently with a rollout process that was already notoriously slow and uneven.

Historical priorities

Although there has been fierce competition to “win the 5G race” this has manifested in markedly different approaches. The GSMA has recently highlighted this divergence, particularly when it comes to investments in the 5G core (more on that below).

Many existing use cases are in the US and Asia, where the emphasis is on faster mobile broadband and fixed wireless. In Europe, particularly the EU, progress has initially been slowed by issues surrounding the allocation of spectrum and a focus on the IoT applications of 5G, and on mobility. A particular emphasis has been put on “pan-EU 5G corridors” to facilitate mobile IoT cases and uninterrupted consumer access.

Wherever it is currently available, 5G is either an urban development serving mobile broadband (in select cities where population density makes it a logical trial deployment zone) or rural “fixed wireless access” (home broadband) for areas where laying sufficient fibreoptic cable would be overly expensive. Verizon and AT&T are working on this latter use case in the US, and in the Republic of Ireland Vodafone has started its own rural 5G trials. How do we even judge issues such as interoperability in such an environment?

Meanwhile, there are differences in the way that countries — and even different operators within countries — are building their new networks. What is particularly interesting here is the concept of “non-standalone” deployments, where new 5G technology is introduced over the top of existing 4G LTE infrastructure.

Standalone vs. non-standalone

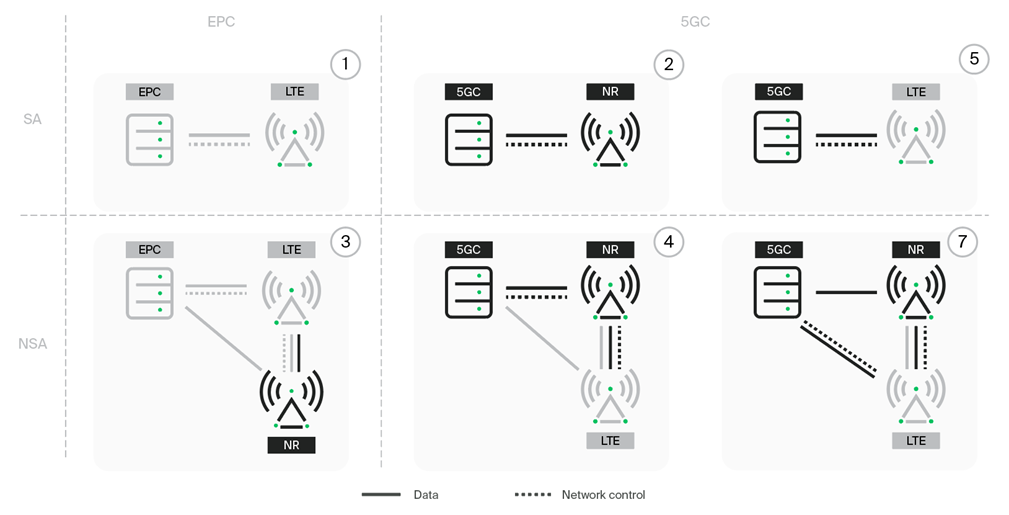

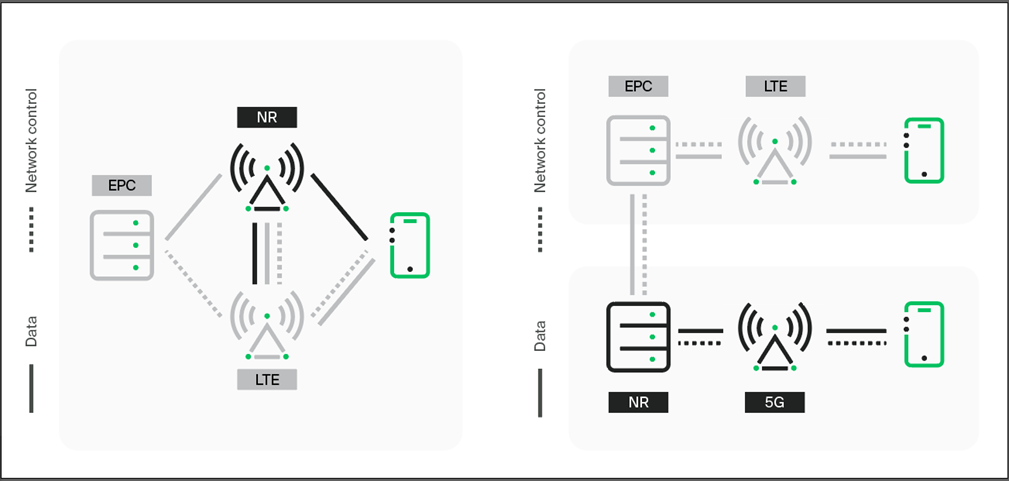

So what is the significance of a non-standalone (NSA) or a standalone (SA) deployment? In the former, two different generations of network connectivity work together to try and facilitate implementation of the newer technology while ensuring good overall coverage. In the latter, one control system runs one radio access technology. The GSMA has laid out six deployment options, 3 NSA and 3 SA.

Option 1 is merely the current state of 4G networks – an Evolved Packet Core driving LTE radio access technology. Options 2, 4, 5, and 7 each use a 5G Core to control LTE, 5G’s “New Radio” (NR) technology, or both in tandem. Option 3 retains the EPC but introduces NR to increase speeds.

For this reason most MNOs seem to be choosing option 3, as the GSMA observes:

Although connectivity yields low margin, it offers a stable revenue stream that will be able to bankroll the deployment of 5G to suit 5G use cases other than mobile broadband [such as IoT]. Furthermore, as mobile broadband is the key value proposition that is offered by the operator [from subscribers’ point of view], excelling in enhanced mobile broadband will differentiate the early adopter from its competitors.

In plain English: operators want to be seen to be deploying 5G by having faster speeds before they have a complete solution in place to support the more interesting use cases.

Hardware manufacturers Ericsson seem to agree with this approach, arguing that it simplifies the process of building out the network, while also acting as a stepping stone to a full SA option 2 deployment. Moving to a standalone option would simplify network operations, particularly as each connection type (LTE or NR) will be controlled exclusively by its own Core, without a middleman.

In fact, Ericsson go further, arguing that it would be best to encourage all operators to deploy option 3, with a view to evolving towards option 2, and discourage the use of other options. “This approach,” they argue “will reduce network upgrade cost and time, simplify interoperability between networks and devices, and enable a faster scaling of the 5G ecosystem.”

The role of the Core

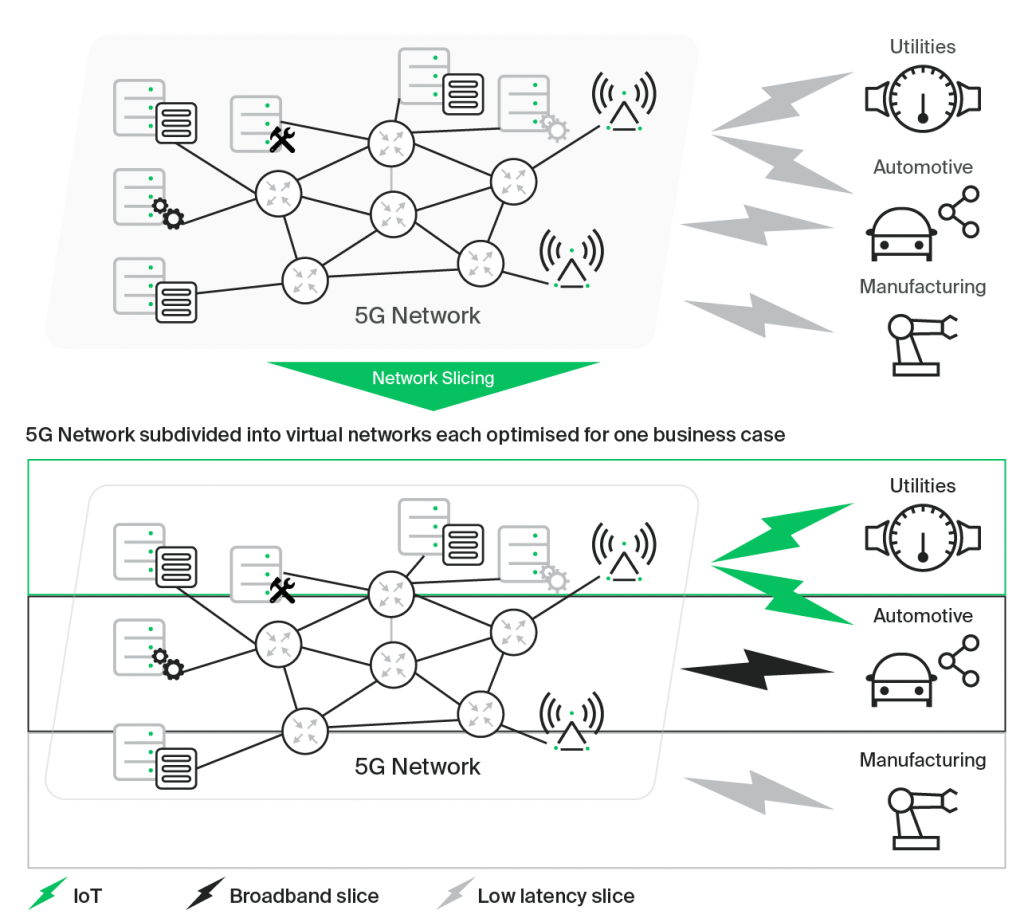

But why is a 5G Core so desirable? In short, because the Core makes it easier to support a variety of complex use cases, including IoT, that have very different requirements.

Crucially, the Core enables unique features of 5G, like virtualisation and network slicing. The GSMA describes the situation like this:

The sub-optimal use of the mobile network is due to the diverse, and even conflicting, communications requirements of… businesses. One business customer, for example, may require ultra-reliable services, whereas other business customers may need ultra-high-bandwidth communication or extremely low latency. The 5G network needs to be designed to be able to offer a different mix of capabilities to meet all these diverse requirements at the same time.

Different use cases may be best delivered over different radio frequencies that provide higher transfer rates, or more reliability over distances. Moreover, several technologies — including IoT, Augmented/Virtual Reality, and smart cities — would benefit from “edge computing,” where network response times are lowered by having essential functions carried out at the “edge” of a network, closer to the triggering devices, rather than a central server.

Source: GSMA, ‘An Introduction to Network Slicing’

Virtualisation and slicing can integrate parts of the network into a discreet, purpose-built network that caters to a specific use. For example, MNOs can create a slice for smart vehicles that delivers and manages high throughput bandwidth for in-vehicle media streaming, coupled with low latency bandwidth for collision avoidance. Alternatively, they can create a slice geared towards mobile marketing and advertising, which prioritises throughput but isn’t overly concerned about latency.

Slicing can even potentially be extended into other networks to create a virtual network across national borders, facilitating roaming.

The Core is a necessity

As the GSMA has also noted, more needs to be done to educate the market about the benefits of 5G beyond higher speed. Doing so might increase demand to a point where investment in a 5G Core becomes more viable.

In the end, networks will need both NR and a 5G Core for any investment to be worth it. Increased speed and connectivity alone will fail to reap dividends. However, 5G has been described as an ‘enabling technology,’ and it currently lacks anything to enable, meaning that operators face a chicken-and-egg situation: the real value of 5G lies in enabling new use cases, but many of these depend on widespread New Radio coverage backed up by a 5G Core.

4G was mainly consumer broadband, 5G has exponential potential and is the critical enabler for Industry 4.0 and the cornerstone for digital transformation.

Gabriel Solomon, Ericsson (via Politico)

Summary

5G is a hot topic, both within the press and in the public consciousness. For those in the know, a great deal of excitement surrounds the new technology and what it unlocks: excitement about autonomous vehicles, about AR, and of course about blazing fast mobile broadband. Yet there is a gap between expectations and reality.

The gap occurs because of the independence of the Core and New Radio, contrasting neatly with the interdependence of 5G and IoT. Most operators seem to be focusing on NR, because this allows them to claim to have rolled out 5G to their subscribers (because they can offer increased speed) while they complete the deployment of the Core, and eventually extend network coverage to a point where their 5G can be standalone.

Thanks to Covid, enterprise demand is now difficult to gauge, and on top of the considerations just looked at, it is unclear what the future of 5G will look like. Experts for the European Parliament note that in some quarters the expectation is that fully mature 5G (full functionality, with extensive geographic coverage) may take up to 10 years to emerge. And now concerns over the quarantine’s effects on spectrum auctions and supply chains for 5G-capable devices, things are even murkier.

As with any new technology, rollout and adoption are tricky things to estimate. 5G just has some extra variables all of its own.