As we leave an extraordinary 2020 it is clear that, as has happened multiple time before, the reality of RCS deployments has fallen short of enthusiastic predictions from just a year before. Last year Mobilesquared expected the number of RCS users to reach 1.4tn by the end of 2020. However, as shown in their live tracker, the actual number has only reached 600 million.

This is largely due to the unusual circumstances of the pandemic. The Economist Intelligence Unit are talking about 2020 and 2021 being ‘lost years’ for growth, and while the telecoms industry has weathered the storm better than most, current conditions are not good for investments in areas beyond improving and securing the core network.

While a minor boom in various types of A2P messaging has brought home the importance of SMS messaging to many networks, the focus for most has been in securing and monetising existing traffic, not launching a brand new service. Nevertheless, RCS is spreading, and there are important developments which will impact its further rollout in the immediate and short terms.

5G & RCS — intrinsically paired

It makes sense that RCS is being put forward as the messaging standard for 5G networks. The new data-oriented networks are perfectly suited for a data-based messaging protocol. Plus network slicing could create layers that are best suited to messaging while leaving bandwidth for other uses like IoT. In turn, RCS will enhance 5G, by providing subscribers with a new, tangible service which demonstrates 5G’s flexibility, bandwidth and low latency.

Moreover, 5G alone may not generate great returns for operators, since subscribers are less willing to pay a premium for new 5G subscriptions. The amount subscribers are willing to pay for 5G has actually dropped from 20% in 2019 to 10% in 2020, for some obvious reasons. In short, the cost of living continues to rise — particularly in Asia and Europe — while the pandemic has put pressure on many people’s spending power. The EIU note that while high earners are largely unaffected by these changes, the same cannot be said for almost everyone else, regardless of market.

In this light, the connection between 5G and RCS could be mutually beneficial, since RCS — or more precisely RCS Messaging — would provide an ancillary revenue stream to justify and support 5G deployments.

This connection has already been made, with some operators drawing up plans for what they call ‘5G messaging’, which is in fact RCS. But what happens if some networks are investing in these technologies and others are not? There are serious concerns around interconnectivity to think about. In particular, if RCS messages are sent from one network to another that can only deliver SMS, it will seriously disrupt the seamless messaging experience — either stopping messages dead, or else causing a serious headache working out how to translate RCS messages to SMS.

It should cause decision makers to think again about their future plans, as it may become less a choice between RCS and 5G, and more a question of how to deploy both, and in what order. The ability to connect subscribers may face obstacles if MNOs are not investing in one technology or the other (or both).

Growing signs of competition

Of course, RCS cannot be — and has never been — considered in a vacuum. The existence of OTT messengers, and the way they have eaten into MNO messaging traffic, was the very reason for the development of RCS. Now those apps are going after the lucrative A2P market. WhatsApp Business Messaging seeks, in some small way, to recreate what WeChat has done so successfully in China. RCS is more ambitious, and has better potential coverage, but it is a late starter in a race that also includes numerous other apps.

In addition, there are other competitors. WebRTC (Web Real-Time Communication) has been in the ecosystem for a while, and offers a lot of the same features as RCS. Discovery can be similar, but because it is an open source set of protocols rather than a channel, users access WebRTC chats through a company’s site in their browser or direct via an app. That cuts MNOs out of the messaging chain, but it also requires enterprises to essentially build their own platform. And WebRTC fundamentally lacks the ability to be used for contacting the end-user proactively — it does not use telephone numbers after all.

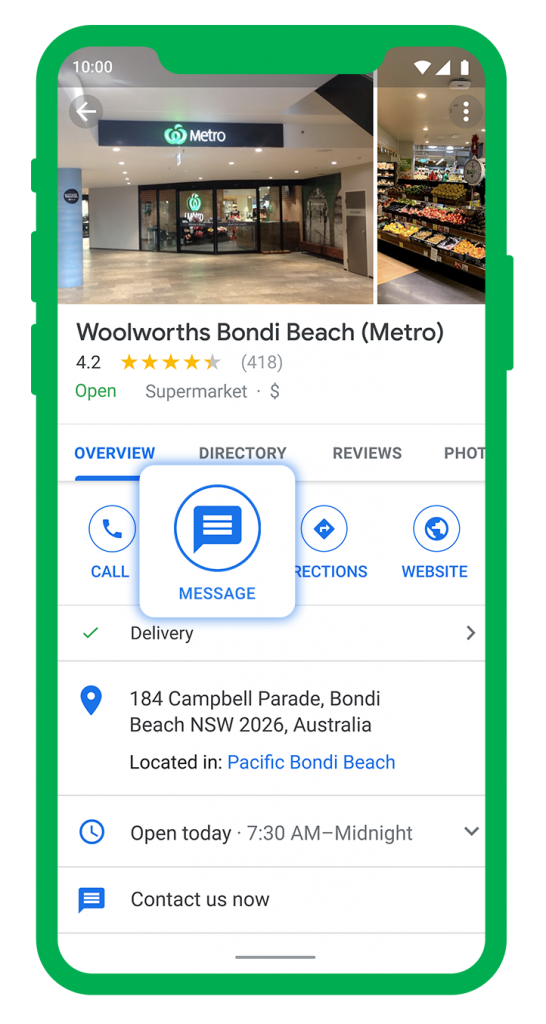

A more direct competitor comes from Google. Although supportive of RCS in theory, Google have come under fire for essentially altering their own RCS solution (delivered via Jibe) to deviate from the RCS standard registration mechanisms and becoming an OTT service. On top of this is a completely separate service: Google Business Messages, accessed via Google Maps. The issue for operators here is that Maps is on all Android phones and a lot of iPhones, and the message function is accessed and operated entirely from the app.

So, this channel not only boasts the universality of RCS, it also has a very similar and convenient method for discovery. To such a degree that many users do not realise the conversation they are conducting is happening within the Maps app — they simply searched for the business and found a means to message that business. Being based within Maps changes the scenario slightly, but there is still a risk that this channel will establish itself before users have a change to become familiar with RCS chatbot discovery, or with using their default messaging inbox as a primary point of contact.

Still growing

As we said at the start, RCS has had a rough 2020. Operators have had to contend with other pressures as a result of the pandemic. Meanwhile Mobilesquared observed a lessening of demand even as demand for other channels rose, in large part because the novelty of the technology makes it appear to be a riskier proposition. However, that same research is showing a resurgent demand in all messaging channels — including and especially RCS — as countries leave lockdown and enterprises seek to entice customers to return.

Moreover, investment in RCS may not just be beneficial, it may become almost essential. To remain competitive in an interconnected telecoms field, networks will have to have some way of supporting RCS and 5G. Meanwhile, A2P revenues will depend on having a robust, flexible, and universal answer to rich messaging channels.

At GMS we believe that RCS will ensure MNOs remain relevant and central to the messaging ecosystem. It just takes will and courage to seize the opportunity. Talk to our experts about conditions in your market and how we can help.